As buy and sell-side organizations turn to the cloud to modernize their infrastructure, data-as-a-service is increasingly becoming the solution for data integration, management and analytics. At Virtu, we pioneered this space by delivering a best-in-class data analytics platform after a multi-year infrastructure rebuild.

Basic programming literacy is becoming more ubiquitous, giving access to those in non-developer roles to create their own API integrations. Because proprietary data can be combined and analyzed with any other third-party sources, the combined possibilities are endless and make advanced interrogations of in-depth data across equity, futures, fixed income and FX possible.

The initial set of APIs addressed client demand for direct access to the data underlying their transaction cost analysis. The catalogue continues to grow across position, venue and trade data covering multiple asset classes.

The opportunity

After a multi-year infrastructure rebuild, we had the opportunity to launch Open Technology, a platform offering secure and easy access to Virtu’s data API catalogue. Equipped with tools that connect, aggregate and quickly upload the raw data to any destination; once translated by business intelligence or visualization tools, the platform helped clients uncover new correlations and discover new insights into their performance.

Packaged service-level options provide flexible programming and ML/AI support to the buy-side

Making technology accessible

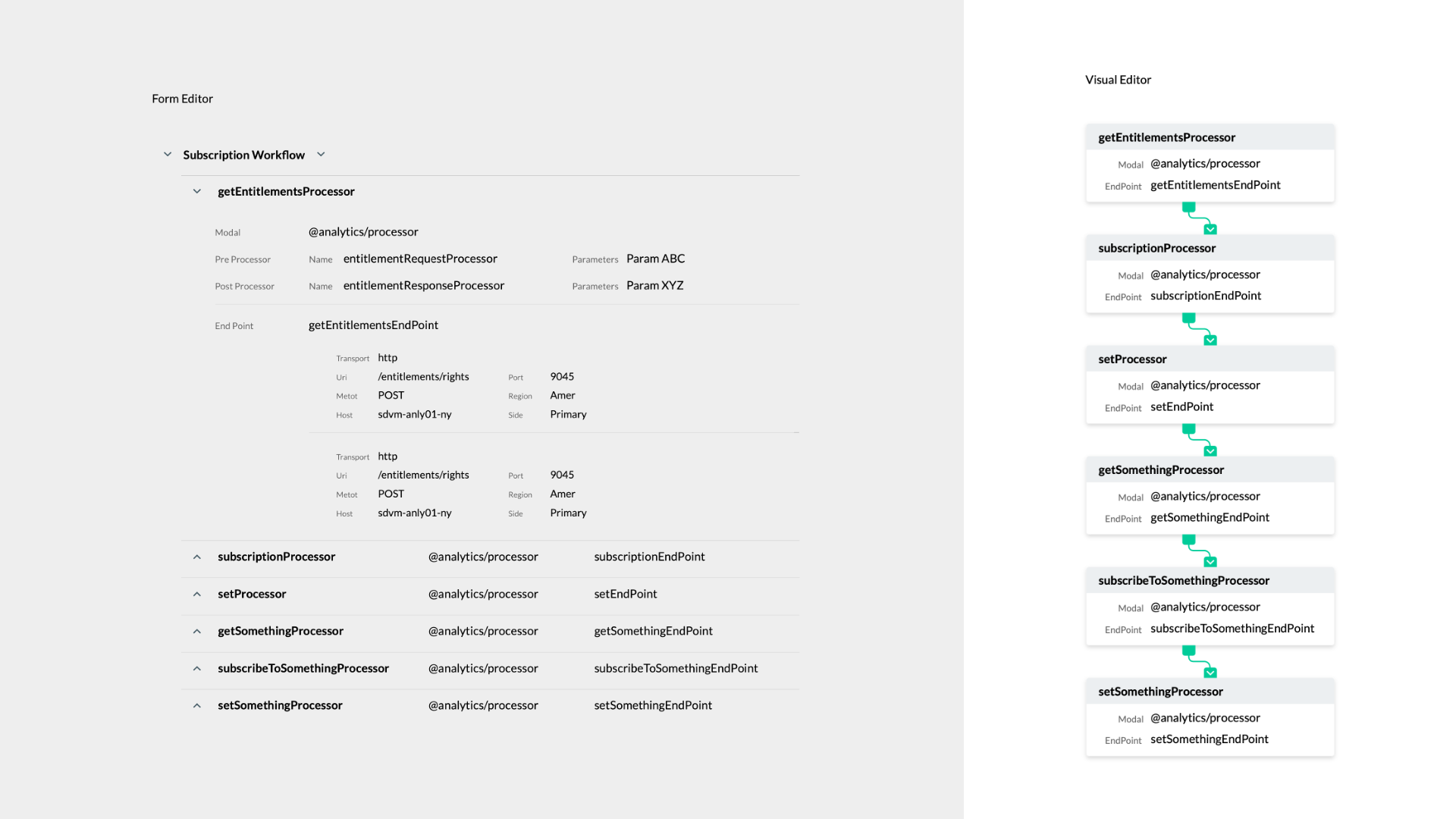

Making technical documentation accessible to a wider audience of non-programmers was both the challenge and the reward when we started to design the solution. We jumped in by first understanding the overall data structure and field definitions, finding ways to simplify the display and figuring out workflows for API creation in a no-code environment.

We use our own products

When it comes to understanding the customer, nothing beats being a one. We rely heavily on beta releases and encourage everyone internally to use our products before we launch them to market. There were many iterations, thorough testing and refinement with product and engineering teams to get the initial release out.

We included sample code in several languages to show clients how to write scripts that could range from simple queries to access benchmark trade data or the analysis of historic transaction cost results.

Building out use cases

To support the launch and adoption of the platform, I worked closely with analytics experts to flesh out tangible use cases to demonstrate the value-add for clients when integrating our analytics within their in-house processes and workflows. We illustrated that by using their programming language of choice, several models were available to help estimate the cost of trading in the open or closing auctions or identify historical block liquidity.

Aite Group recognizes the innovative financial institutions that have leveraged best-in-class technology in the capital markets.