The constantly evolving trading landscape makes for a challenging problem-space when delivering innovative and adaptable solutions. At Virtu Financial, I had the opportunity to define the next-generation vision for the execution management system (EMS) and partner with product and engineering teams to build out an integrated, multi-asset trading platform via web, desktop, and APIs.

The challenge

As automation is more widely adopted and consolidation of buy-side asset managers becomes the norm, trading desks begin to shrink in size and the typical trader starts to look more like a quant trader: a hybrid of strategy and execution roles. These hybrid traders expect greater sophistication in functionality and more automation of manual and voice-trading activities, fundamentally changing the way we have been designing these systems to date.

Responsible for overseeing a team of UX consultants conduct desk research and assess the overall landscape. Jointly developed artifacts to help describe existing user base across multiple business lines to help align stakeholders with the overall vision.

The process

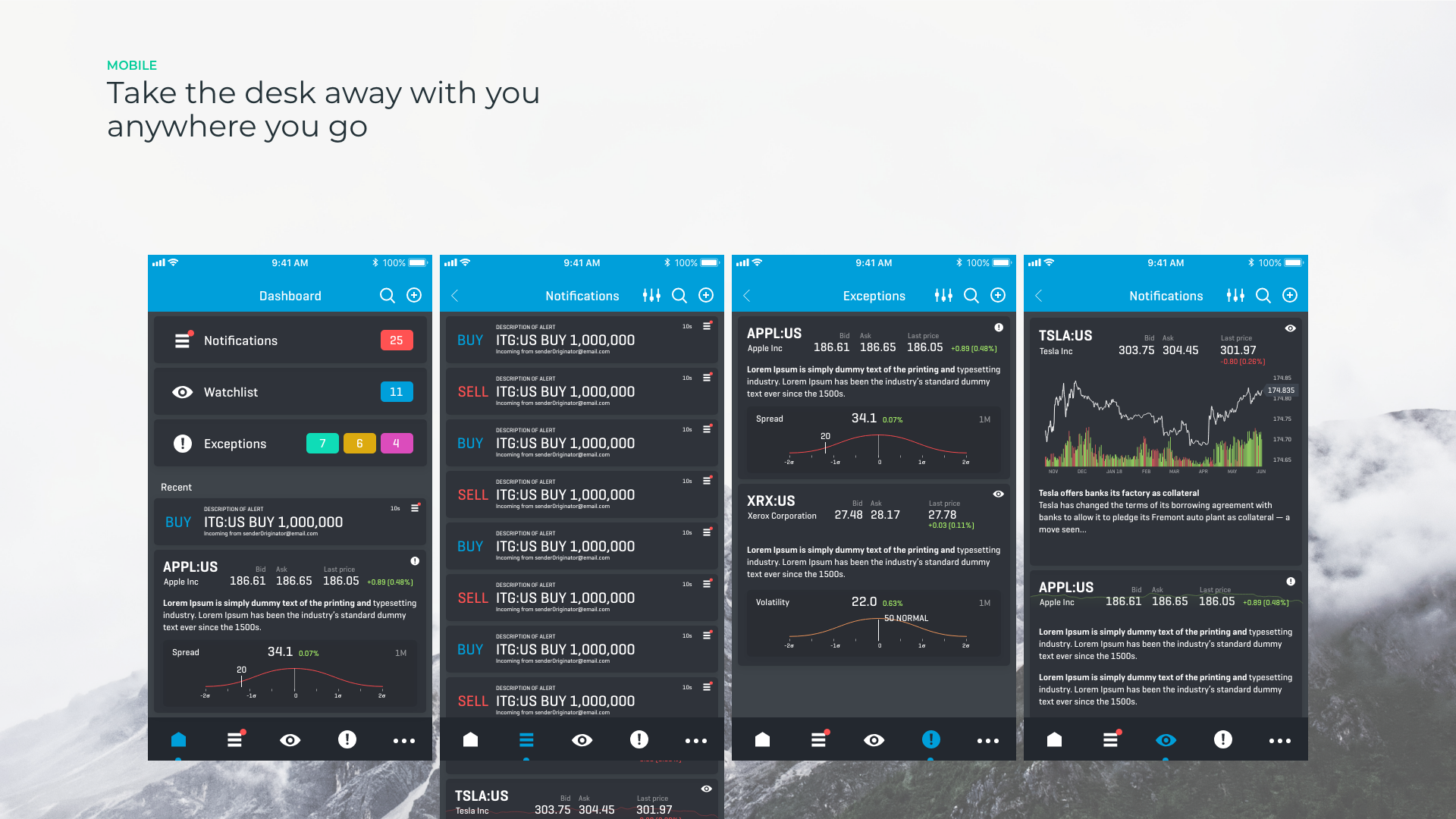

To create a vision for a next-generation execution management system required us to anticipate and take advantage of movements in trading practice, to leverage the best of modern interaction design and web technologies, and to deeply understand the needs of internal and external users. Owning the end-to-end experience process, I oversaw a team of UX researchers, designers and engineers to deliver wireframes, visuals and prototypes to bring the vision to life.

Identified key industry trends and established working assumptions

Defined the overall product strategy and interoperability of services

Conducted workshops in London and NYC with multiple internal stakeholders

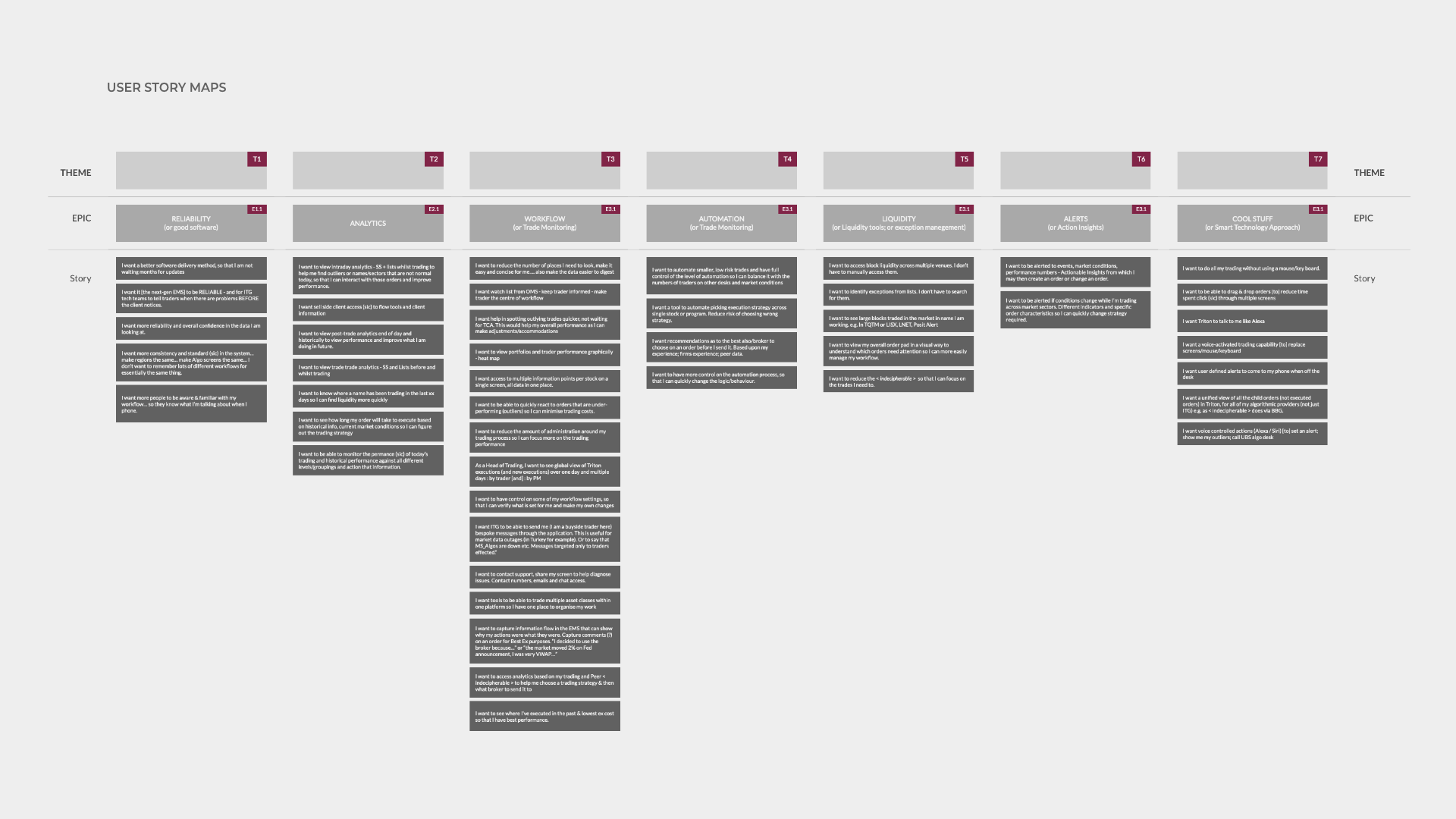

Generated user story maps to describe, categorize and prioritize features

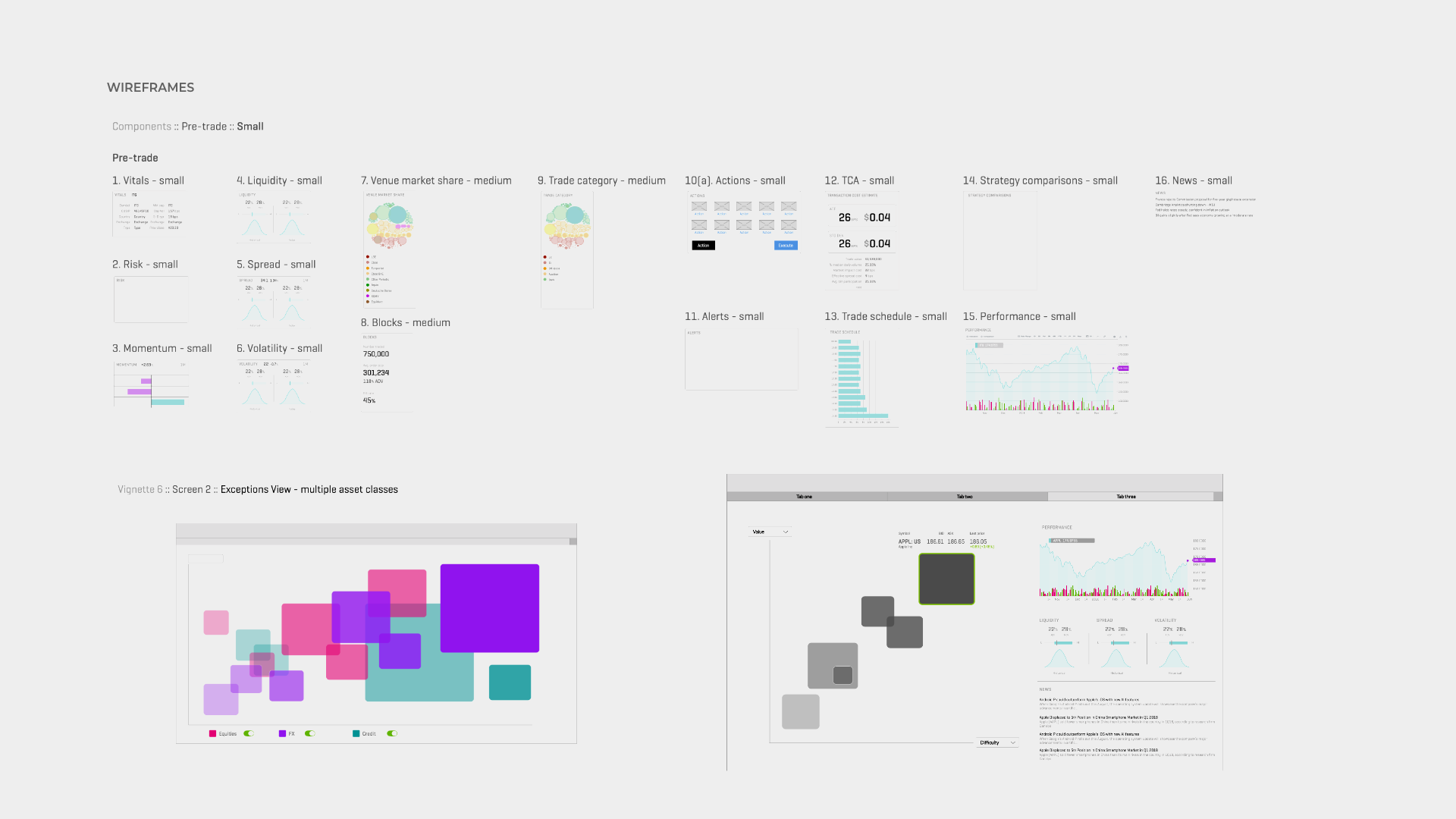

Prioritized main use cases to drive detailed specifications and prototypes

Championed disruptive ideas to foster innovation from project inception

Reviewed and iterated on main UX deliverables including wireframes and flows

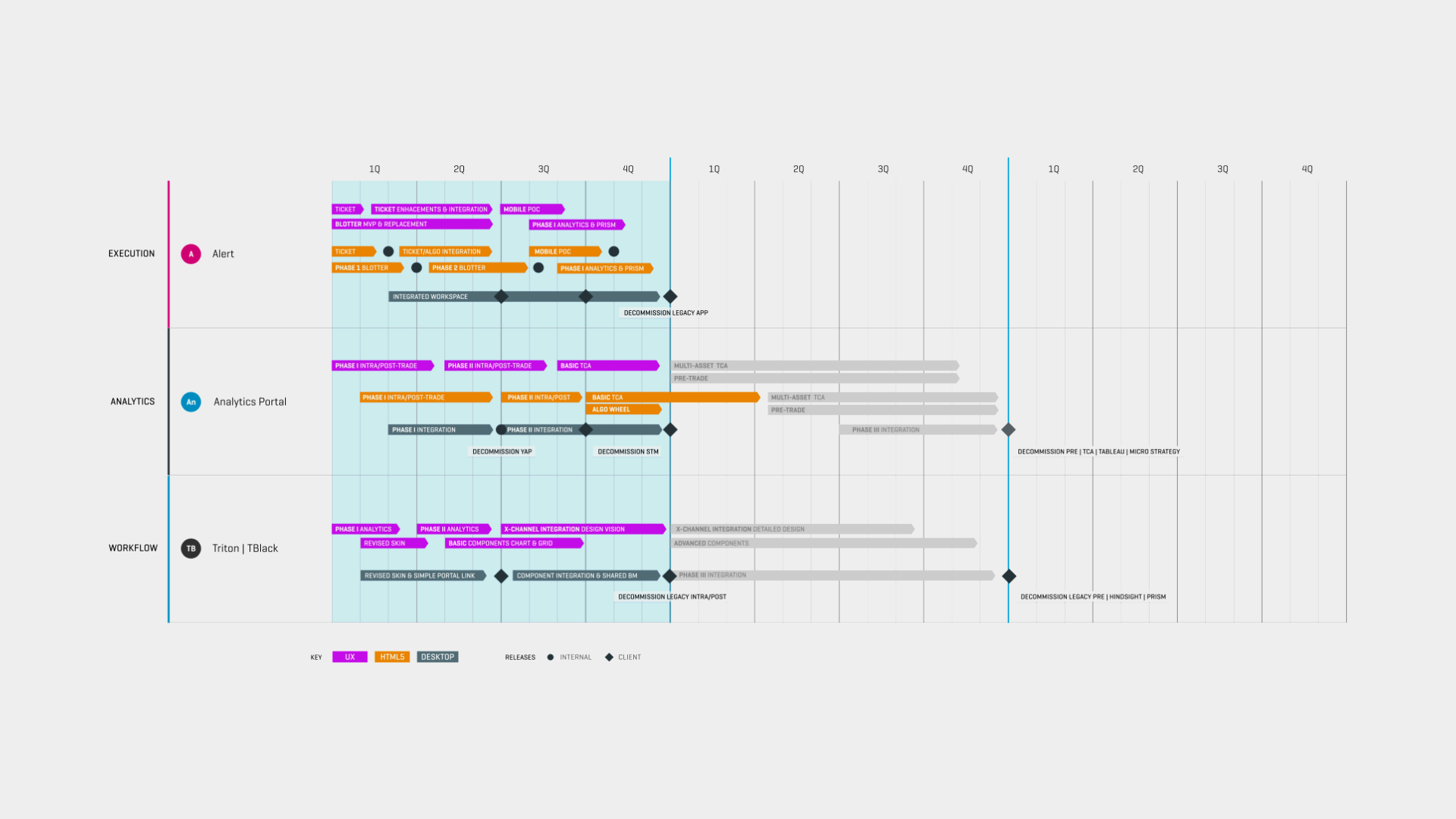

Developed a product roadmap to phase delivery to clients

The solution

An XR-extensible suite of AI micro-services for exception-based trading

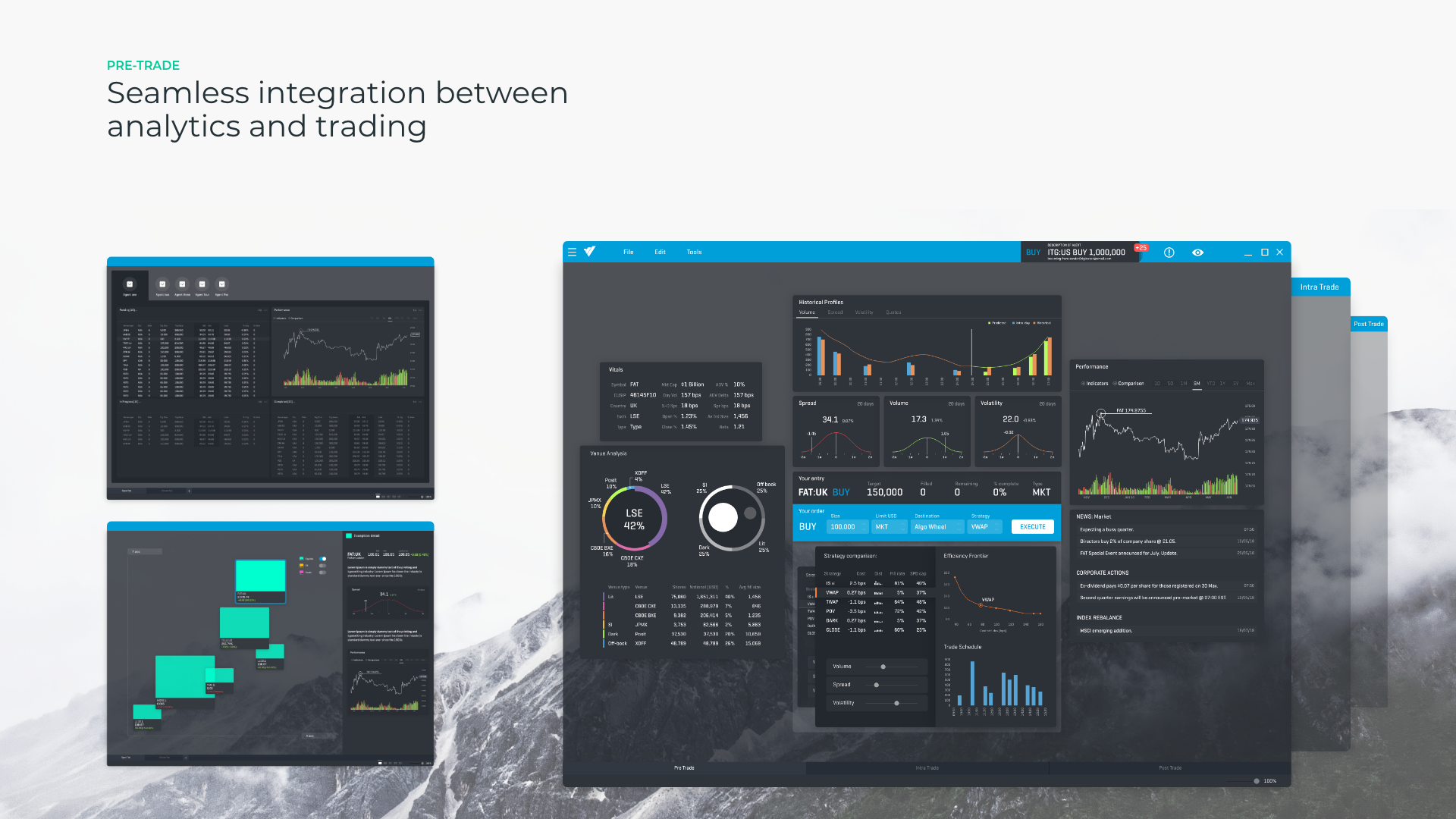

Combining the user stories generated in the discovery phase with forward-thinking ideas like hybridization, semi-autonomous AI software and exception-based trading, we put together a vision for both the near and long-term future.

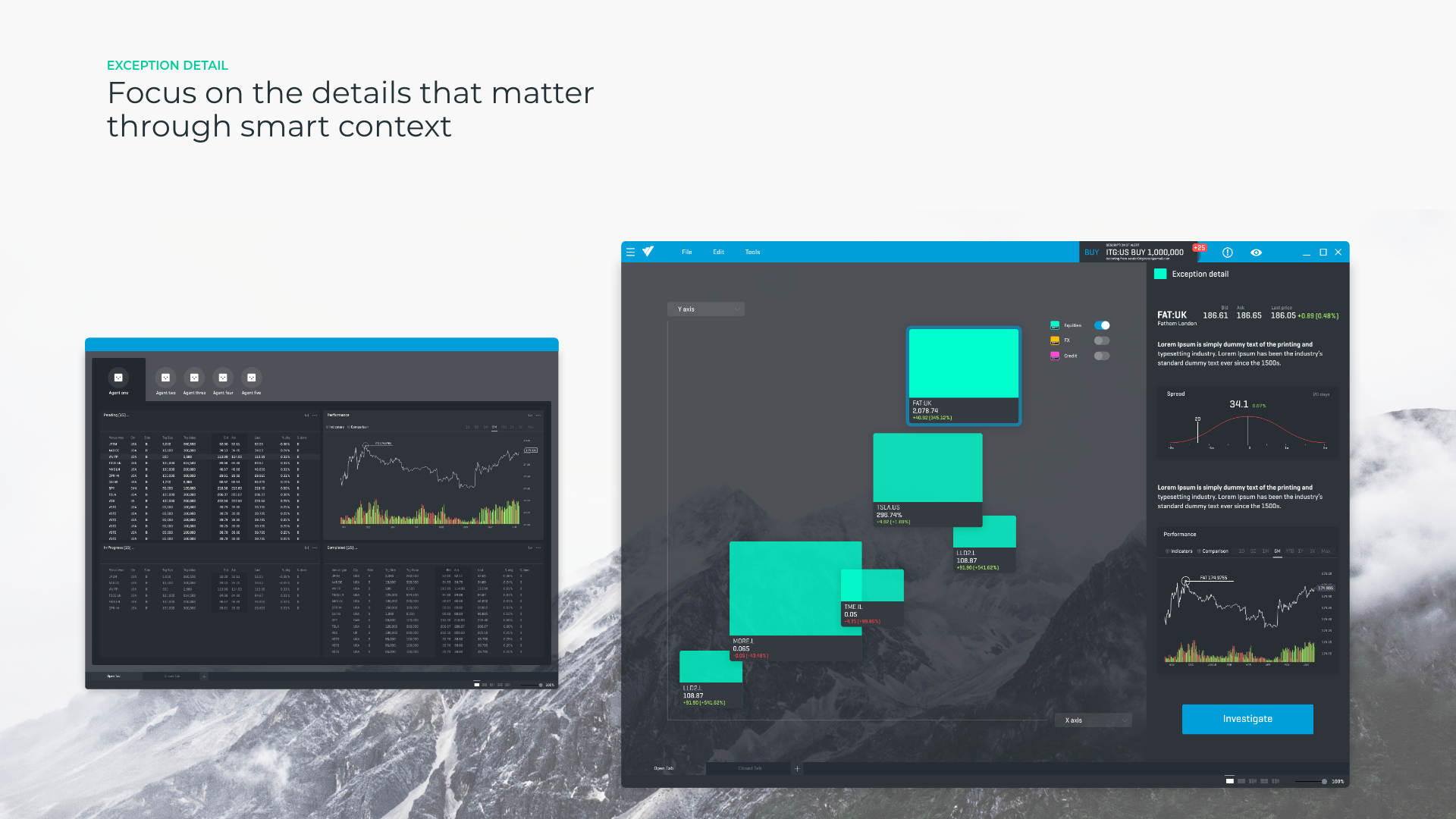

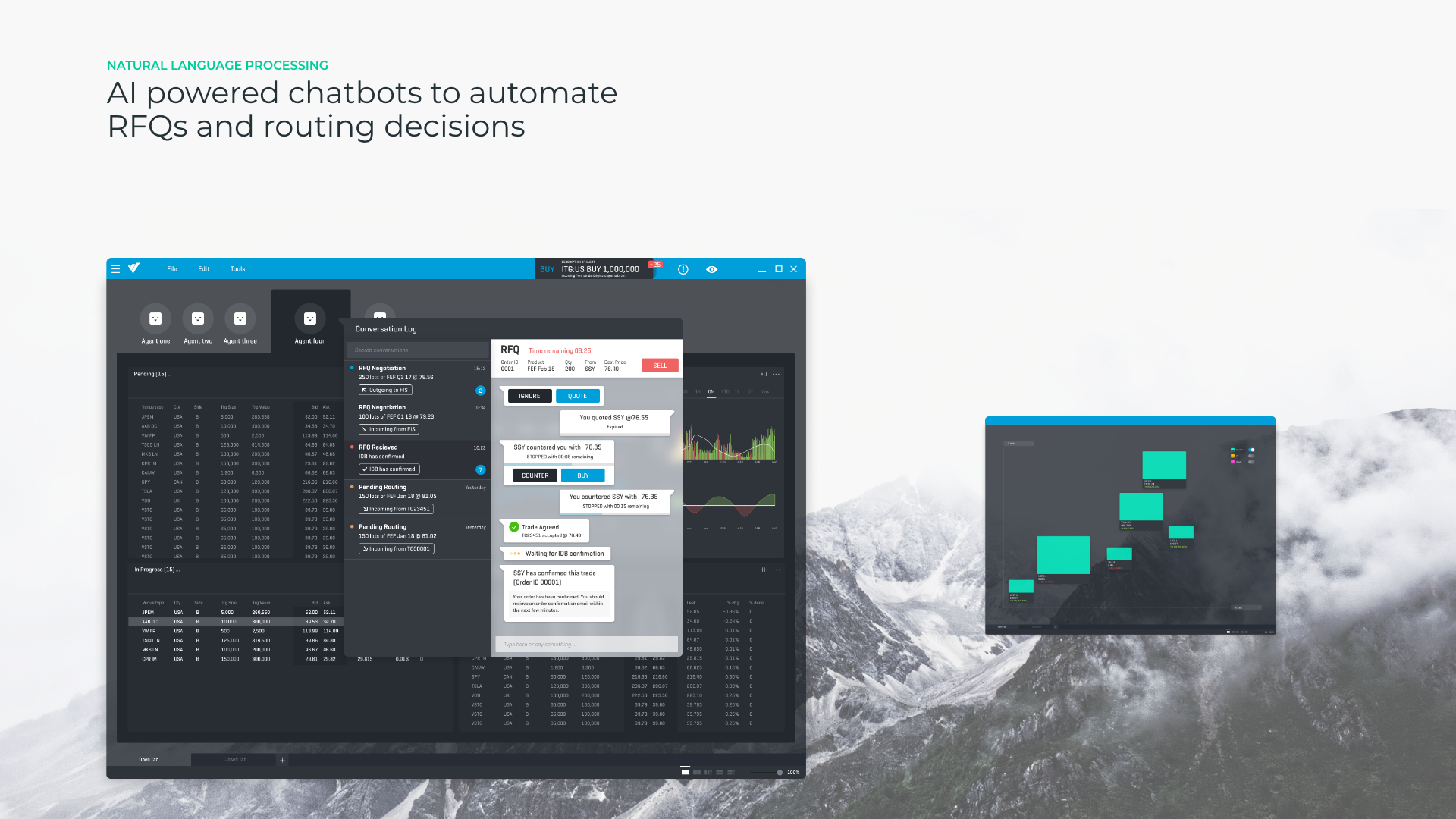

In our vision, trading is a strategy-heavy activity with the vast majority of execution-related activity delegated to a substrate of AI agents. Think Alexa for Trading; or Siri for Equities. Only when an agent is unable to process a trade—an exception—does a human agent need to become involved.

Prototype

The vision contained no sky hooks, or unfeasible technologies and improbable scenarios. Even though we explored nascent technologies like gesture detection, foveated rendering and NLP in the context of trading, we did not want to rely on any prostheses or other wearables. It was important we delivered value on the short-term, whilst being able to explore the XR-extensible technologies in parallel.